One line on the cap table

Bundle 100+ angels, operators, and friends into a single entity. Keep your voting rights. Lose the admin headaches.

Don't chase 50 signatures for your next round. Don't pay $30k in legal fees for a "Party Round". Use an RUV to aggregate small checks into one powerful vehicle.

Entity

DelawareVoting

Proxy assignedAccreditation

AutomatedWires

AggregatedThe 'party round' mess

Raising from 50 angels sounds great until you have to manage them. "Party Rounds" without an RUV create long-term structural debt for your company.

Cluttered Cap Table: 50+ lines make Series A diligence a nightmare. Institutional VCs hate seeing a "messy" cap table.

Signature Chasing: Every corporate action (new round, acquisition, pivot) requires chasing 50 signatures. One missing angel can block a deal.

Legal Costs: Lawyers charge per investor for processing subscriptions and accreditation. A $500k round can cost $30k in legal fees.

Information Rights: Leaks happen when too many people have direct access to your financials and updates.

2000 Shareholder Rule: Public companies are triggered by having too many shareholders. Direct investors count against this limit; an RUV counts as 1.

The RUV solution

An RUV allows you to treat 100 investors as a single entity. It's cleaner, faster, and gives you total control.

One Line Item: "Infra One RUV, LLC" is the only name on your cap table. Your investors are underlying members of this LLC.

Proxy Voting: You (the founder) hold the proxy vote for the entire vehicle. You never have to ask the RUV for permission to raise your next round.

Zero Cost: Setup fees are covered by the investors (pro-rated), not the company.

Instant Links: Send one URL. Investors sign & wire automatically. We handle the KYC/AML.

Series A Ready: VCs love RUVs because it means they only have to deal with one entity during diligence.

Two ways to clean up

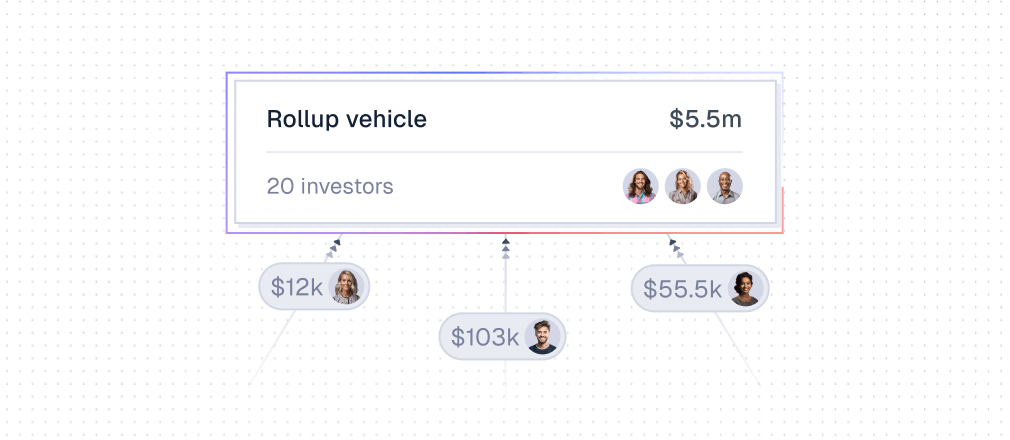

Rollup vehicle (RUV)

Use this when raising NEW money.

You are raising a Seed or Pre-Seed round. You have 20 angels who want to put in $5k - $25k each. Instead of sending them all a SAFE, you send them one RUV link.

Best for: Pre-Seed, Seed, Bridge Rounds

Instrument: SAFE, Convertible Note, or Equity

Timeline: Set up in minutes, close in days

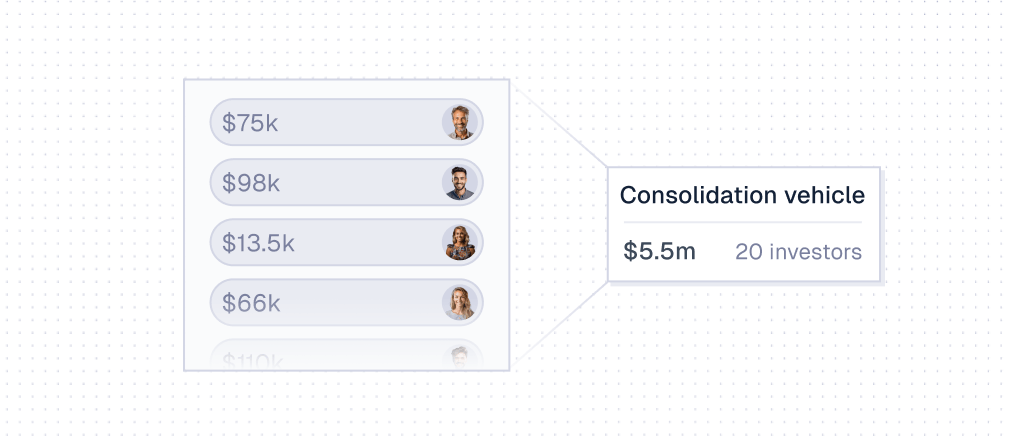

Consolidation vehicle (CV)

Use this for OLD money.

You already raised money 2 years ago. Your cap table is a mess with 40 direct angel investors. You need to clean it up before your Series A. We move them all into a CV retroactively.

Best for: Pre-Series A/B cleanup, M&A prep

Action: Retroactive transfer of shares

Benefit: Reduces administrative burden instantly

Supported instruments

SAFEs

Y-Combinator Standard or Custom. The most common way to use an RUV.

Convertible Notes

Debt instruments with interest rates and maturity dates. Fully supported.

Priced Equity

Common or Preferred Stock. We handle the complex subscription agreements.

The workflow

Setup

Input your deal terms (Valuation Cap, Discount). We auto-generate the RUV entity and a custom landing page.

10 minutes

Invite

Send the link to your angels. You can set minimum ($1k) and maximum check sizes per investor.

Share link

Onboard

Investors sign electronically. We handle accreditation (506c) and KYC instantly via our dashboard.

Automated

Fund

Funds land in the RUV bank account. You track the total raised in real-time.

Aggregated

Close

You sign once. We wire the total amount to your company. The RUV is added to your cap table.

One wire

Build for Angels

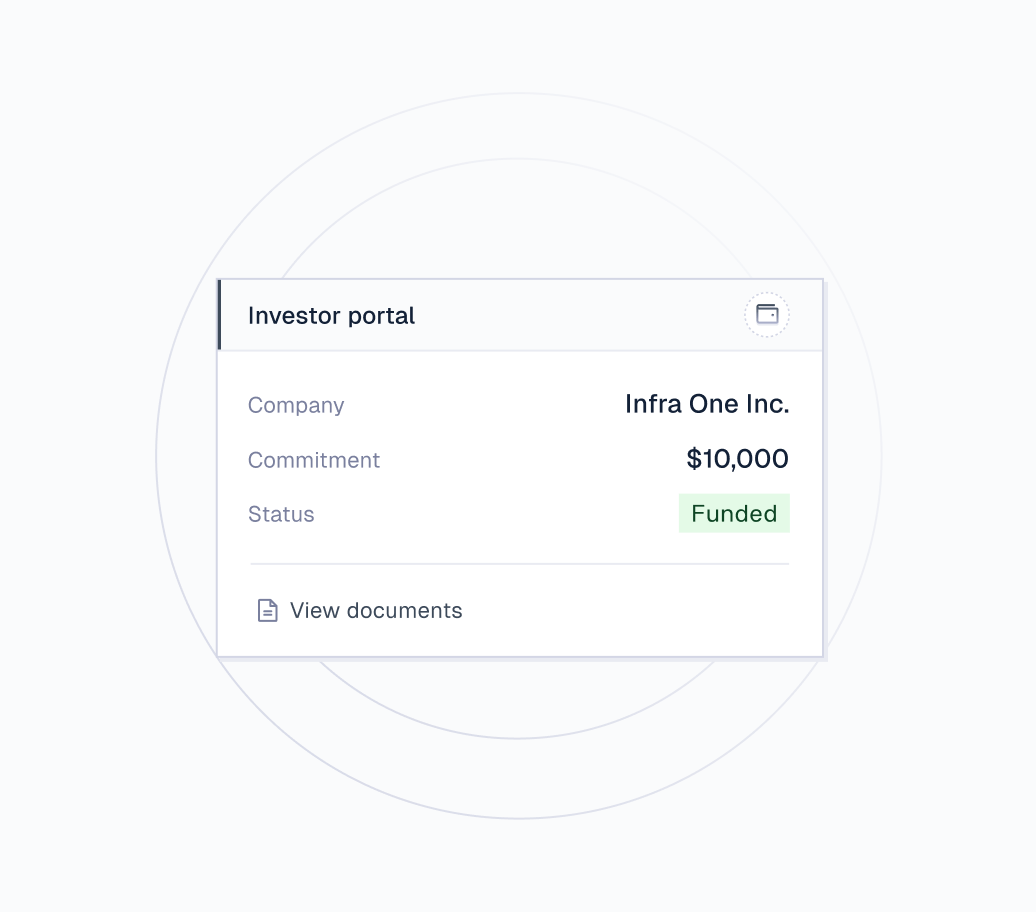

Your investors will love it. We provide a professional, institutional-grade portal for them to manage their investments in your company.

- One-click Signing

- Portfolio Dashboard

- Automated Tax Docs (K-1s)

- Wire Instructions & Tracking

Transparent pricing built around how fund managers actually operate

Choose your fund structure to see the pricing that applies to you

For founders

$0

Free for the company. We pass costs to investors.

Setup & Formation

$0

Bank account

$0

Bank account

$0

Bank account

$0

*You are responsible for State Filing fees (Blue Sky), which are typically ~$500-$1500 passed through at cost.

For investors

~2%

One-time setup fee pro-rated across the pool.

Example Calculation

Total raise

$250,000

Setup fee

$8,000

Cost per investor

3.2%

An investor putting in $10k pays ~$320 in fees.

Annualized costs consist of an up front setup fee and an ongoing fund services fee over 10 years. Annualized cost assumes a 10-year fund lifetime.

Knowledge base

Infrastructure partners