Launch and operate your fund with expert support at every step

Infra One guides you through each phase of formation and administration, ensuring that every legal, regulatory, and investor-facing step is completed correctly and on time.

Comprehensive support across the entire fund lifecycle

Fund and SPV formations

Utilize our global investment management fund structures, vetted by top law firms.

Entities incorporation, Fund registration, Legal documents

Pitchdecks, datarooms, electronic signatures

Paired with co-investment vehicles that suit your needs

Built on a foundation of expertise and seamless execution

Cross-jurisdiction expertise

We handle structural and regulatory nuances across global fund hubs so your vehicles stay compliant from day one.

Operational coordination

Formation, documentation, investor workflows, and reporting live inside one aligned process.

Dedicated support team

Specialists who know your structure stay involved throughout every stage of the fund lifecycle.

Measured impact, real results

5k+

active vehicles launched and maintained across vehicles

$4m+

in assets structured through Infra One entities globally

88%

of managers return to launch additional vehicles within 12 months

Chosen by leading funds and institutions

Infra One made what used to be a painful process simple and fast. They handled the setup, admin, and reporting so we could start investing and raising immediately.

Brian Nichols

GP, Oakmont Ventures

The difference working with Infra One was immediate. The usually painful, months-long setup became a guided, intelligent workflow. They streamlined compliance, admin, and reporting, giving us clarity at every step. We were able to start raising and investing almost immediately.

Zach Wallace

GP, VoltOne

Infra One made fund setup effortless. We launched faster and with far less admin.

Nicol Reynolds

GP, Aurion VC

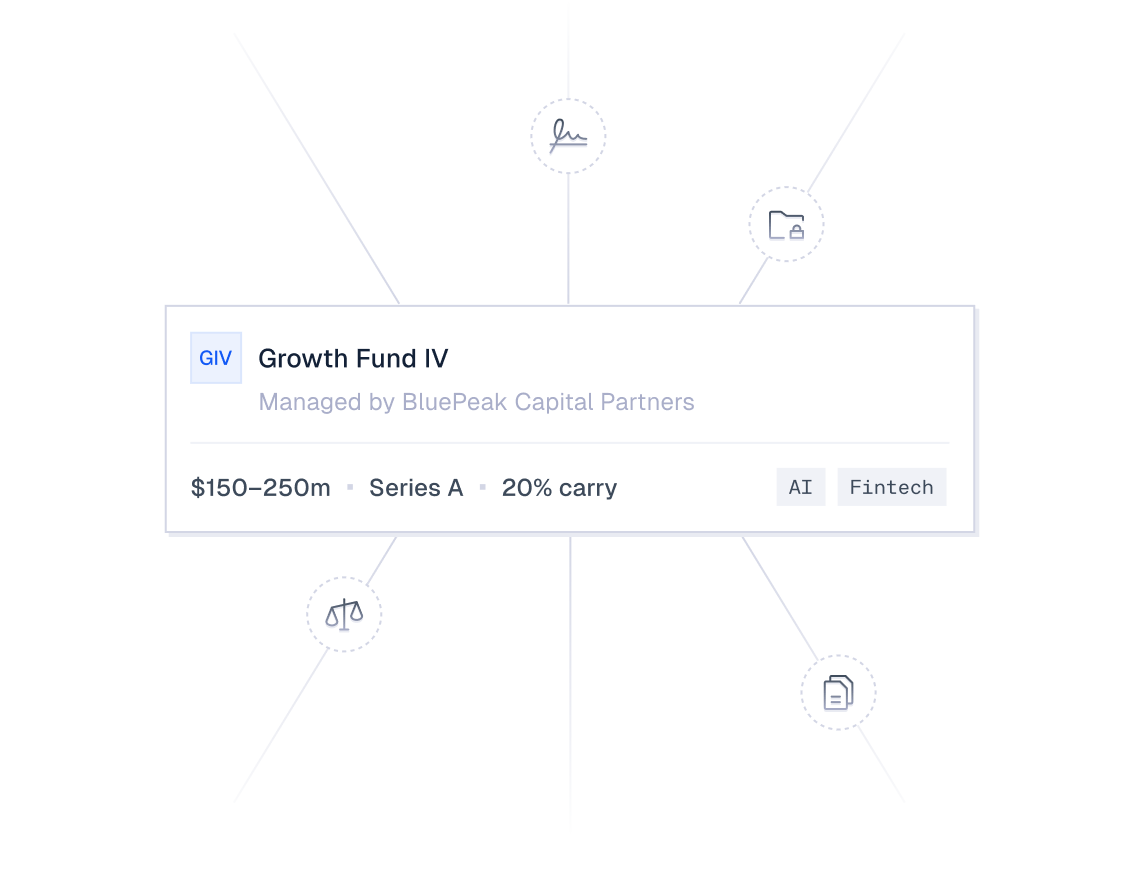

Fully delivered infrastructure for GPs

Ventures

Create fund pages where investors can commit capital and track their investments in real-time.

Contacts

Sync with your email providers to manage contacts and send invitations through an integrated CRM.

Data room

Organize and share important documents with investors through secure, shareable links.

Expenses

Upload receipts and invoices to automatically digitize and organize your expense records.

Multiples

Upload PDF reports and automatically convert data into interactive graphs and charts.

Events

Create and manage fund events while tracking your complete event history.

Fund

Launch multi-LP structures with automated capital calls and real-time investor tracking.

Rollup

Consolidate smaller checks into one vehicle to simplify governance and administration.

SPV

Spin up deal-specific vehicles to pool capital and execute single-asset investments efficiently.

Feeder

Route capital into your master fund while managing distinct investor groups separately.

Overview

Secure seed-level allocation in later-stage deals using a compliant sponsor engine.

Time Machine

Access historical deal data and track allocation changes over time with complete transparency.

GP 1 Seed

Secure seed-level allocations in your highest-conviction deals through the Alpha Protocol.

GP 1 Commit

Commit capital to deals with enhanced allocation rights and sponsor economics.

Management

Ventures

Create fund pages where investors can commit capital and track their investments in real-time.

Contacts

Sync with your email providers to manage contacts and send invitations through an integrated CRM.

Data room

Organize and share important documents with investors through secure, shareable links.

Expenses

Upload receipts and invoices to automatically digitize and organize your expense records.

Multiples

Upload PDF reports and automatically convert data into interactive graphs and charts.

Events

Create and manage fund events while tracking your complete event history.

Vehicles

Fund

Launch multi-LP structures with automated capital calls and real-time investor tracking.

Rollup

Consolidate smaller checks into one vehicle to simplify governance and administration.

SPV

Spin up deal-specific vehicles to pool capital and execute single-asset investments efficiently.

Feeder

Route capital into your master fund while managing distinct investor groups separately.

Alpha Protocol

Overview

Secure seed-level allocation in later-stage deals using a compliant sponsor engine.

Time Machine

Access historical deal data and track allocation changes over time with complete transparency.

GP 1 Seed

Secure seed-level allocations in your highest-conviction deals through the Alpha Protocol.

GP 1 Commit

Commit capital to deals with enhanced allocation rights and sponsor economics.