Upgrade your access in your highest-conviction deals

The Time Machine is Allocator One's sponsor-economics engine: a legal, LP-defensible way for top GPs to secure a $200k seed-level allocation inside a later-stage deal — by leading a $2m SPV on Infra One.

How Time Machine creates better economics

The structural mechanics that turn limited

pro-rata into meaningful ownership and LP value.

$200k

Your guaranteed allocation

kept at origin-level pricing

50-70%

Preferred GP pricing for originating

and structuring the deal

$2m

The SPV you lead on Infra One

to scale your position

2-3x

Immediate paper uplift for LPs

participating in the SPV

A structure where everyone wins

Preferential pricing for GPs, premium deal access for Allocator One, and instant uplift for LPs.

For the GP

Instant TVPI uplift

Immediate value recognition — no need to wait for an exit.

Maintains ownership in winning companies

Stay protected from dilution in your strongest positions.

Incentivizes bringing best deals to our LPs

Aligned economics create a continuous, positive flywheel.

For Allocator One & LPs

Privileged access to de-risked rounds

High-conviction follow-on opportunities from proven GPs.

Deepens partnership with top managers

Strengthens relationships with the best GPs in our network.

Strengthens ecosystem quality

Elevates the overall caliber of our investment network.

Rewind the price, keep the allocation

Here's a simple step-by-step breakdown that shows how the allocation gap is filled and how dual-pricing creates the economic advantage.

Talk to a humanSeries B deal allocation $2m

$30,000

A single, transparent fixed fee for each Alpha Protocol deal. No hidden terms, no complexity.

Zero Carries

"We take all the carry complexity out." The structure is clean and easy for LPs to understand.

Opportunity Fund

Powered by Allocator One’s Opportunity Fund, forming a mutually beneficial dynamic.

A structure designed to compress time, not just package an SPV

£200k at origin pricing

Inside any A/B deal you source

Lead a £2m SPV

Powered by Allocator One capital

Founder-clean

Single cap table entity

LP-safe economics

Transparent sponsor terms

Infra One execution

Docs, compliance, wiring, cap tables

Sourcing advantage

Differentiated deal access

Elite GP network

Differentiated deal access

Timeline compression

Rewind to where conviction started

£200k at origin pricing

Lead a £2m SPV

Founder-clean

LP-safe economics

Infra One execution

Sourcing advantage

Elite GP network

Timeline compression

Access for all, whichever lane you're coming from

Allocator One GPs

If you're part of the Allocator One network, Alpha Protocol is already unlocked for you.

Automatic access upon fund formation

1–3 Alpha Protocol allocations per fund cycle

Priority SPV formation on Infra One

Infra One recognizes you instantly

External GPs

A small number of non-Allocator-One GPs can apply. We look for:

Deep founder trust

Consistent sourcing of A/B rounds

High-signal conviction

Clean LP setups

See the difference Time Machine makes

Your check

$200k

Entry valuation

$20k (Series A)

Your ownership

1.0%

LP markup

None

Time Machine approach

SPV you lead

$2m total

Your allocation

$200k at seed ($10m)

Your effective ownership

2.0% (2x traditional)

LP markup

Immediate 2x

Everyone wins. You get 2× ownership. Your LPs see immediate markup. Founders get a clean cap table. Allocator One gets access to your deal flow. No gamesmanship.

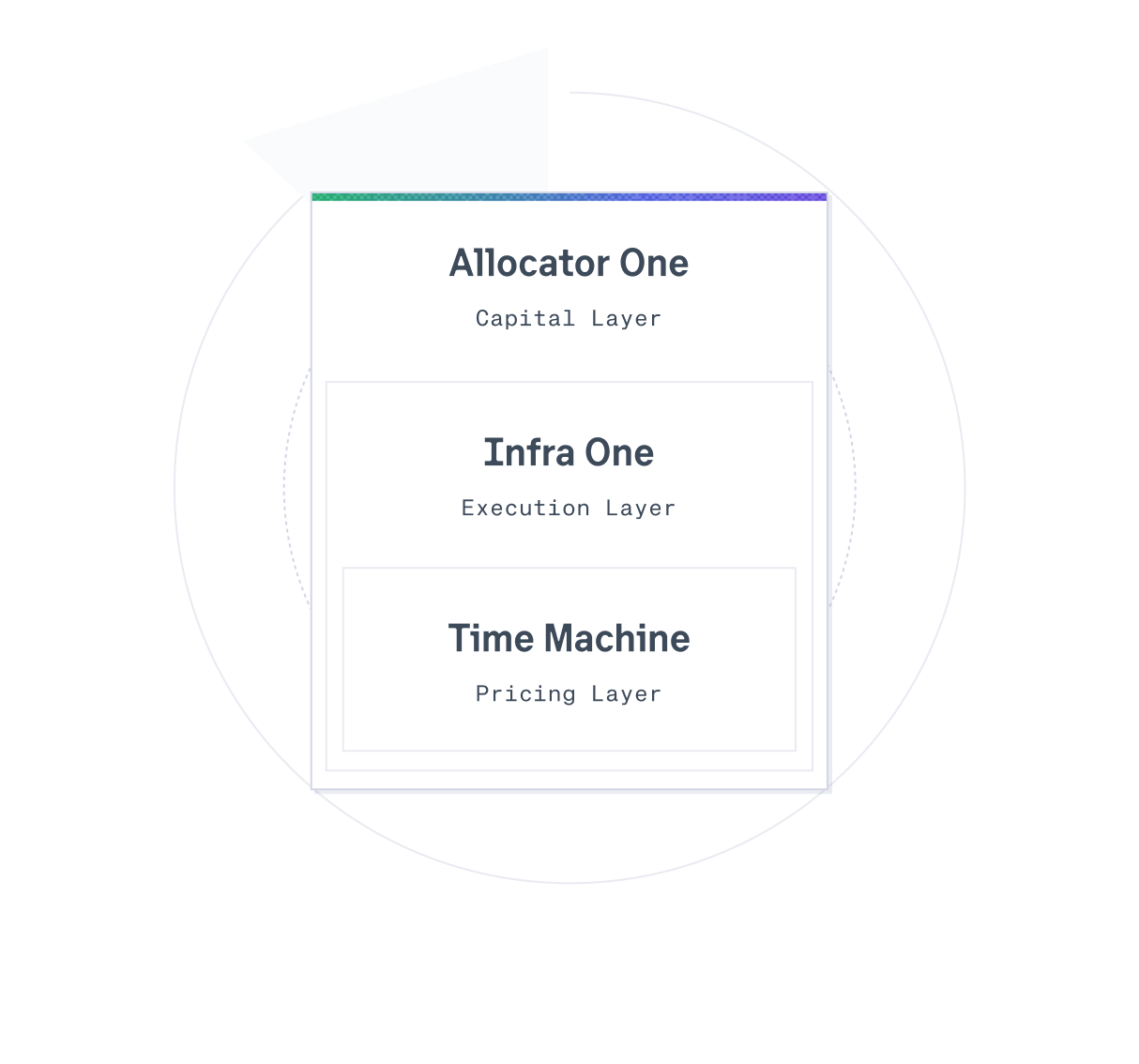

Time Machine operates across three tightly integrated layers to deliver the full economics and execution model

Capital Layer

Execution Layer

Pricing Layer

£1.8m commitment per SPV from the Allocator One Opportunity Fund

SPV formation, compliance, cap table management, wiring

Dual-pricing sponsor economics with full disclosure